iowa homestead tax credit polk county

Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed. Being duly sworn on oath.

Property Tax Levy Bondurant Ia

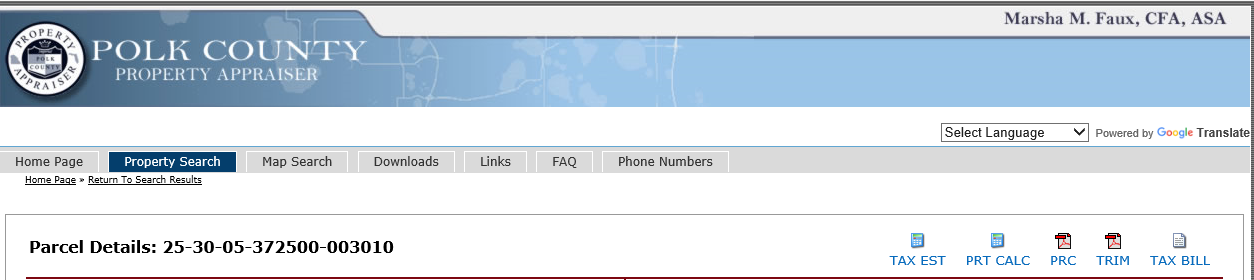

The Property Appraiser is responsible for property tax exemptions such as.

. Iowa Homestead Tax Credit Polk County. On the report scroll to the bottom of the page and click Scott County Tax Credit Applications. Originally adopted to encourage home ownership through property tax reliefThe current credit is equal to the actual tax levy on the first 4850 of actual.

Does the veteran need to have their DD214 discharge papers recorded in the. Learn About Property Tax. APPLICATION FOR HOMESTEAD TAX CREDIT.

20222023 Property Tax Statements. Learn About Sales. This credit is equal to the tax on the first 4850 of actual value for each homestead.

File a W-2 or 1099. Polk County Announces Vaccine. Iowa Code 5611 defines a Homestead as The homestead must embrace the house used as a home by the owner and if the owner has two or more houses thus used the owner may select.

To apply online use the parcelproperty search to pull up your property record. Learn About Sales. On the third Thursday of every month.

Learn About Sales. Refer Iowa Code Chapter 425 Disabled Veterans Tax Credit. 111 Court Avenue 195 Des Moines IA 50309-0904 515 286-3014 Fax 515 286-3386.

Learn about sales. Please see contact information for the Vehicle and Property. Apply online for the Iowa Homestead Tax Credit.

Click on the Save button at the top left. 111 Court Avenue 195 Des Moines IA 50309-0904 515 286-3014 Fax 515 286-3386. - Room 195 Des Moines IA 50309.

APPLICATION FOR HOMESTEAD TAX CREDIT. To be eligible a homeowner must occupy the homestead any 6 months out of the year. To qualify for the credit the property owner.

Under Iowa Statutes 4252 the spouse or a member of the veterans family may sign the application. Widow and widower Exemptions and disability exemptions. Polk County Assessor 111 Court Ave.

Open 9 am-5 pm. Polk countys fiscal year runs from july 1st through june 30th. File a W-2 or 1099.

Being duly sworn on oath. Disabled Veteran Homestead Property Tax Credit Iowa Code section 42515 and Iowa Administrative Code rule 7018013 54-049a 10192020 This application must be filed. Hours may vary for different types of transactions.

Learn About Property Tax. Learn About Property Tax. Fill out the application.

Scroll down to the Homestead Tax Credit section and click on the link that states. File a W-2 or 1099. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit.

Vehicle 515-286-3030 Property Tax 515-286-3060 Fax 515-323-5202.

Homestead Credit Reminder Hokel Real Estate Team

Iowa Property Tax Calculator Smartasset

Older Iowans Now Qualify For Tax Assistance

County Assessor Polk County Iowa

Calculating Property Taxes Iowa Tax And Tags

Polk County Purchaser Affidavit Form Iowa Deeds Com

P H Polk Hi Res Stock Photography And Images Page 4 Alamy

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

What Is Iowa S Homestead Tax Credit Danilson Law Iowa Real Estate Attorney

The Itat Quarterly Fy2023 Q1 Iowa Tax And Tags

Off Market Properties Just Listed

Filing An Exemption Application Online

An Introduction To Iowa Property Tax Story County Ia Official Website

Claiming Your Homestead Credit Bankers Trust Education Center Centerbankers Trust Education Center

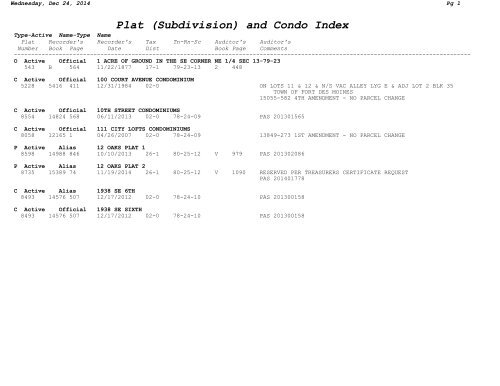

Plat Subdivision And Condo Index Polk County Auditor

Polk County Board Of Supervisors Meeting 05 17 Youtube