iowa city homestead tax credit

If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site. 54-019a 121619 IOWA.

How Do You Know If You Qualify For The Missouri Property Tax Credit Government And Politics Dailyjournalonline Com

A homestead tax credit shall be allowed against the assessed value of the land on which a dwelling house did not exist as of January 1 of the year in which the credit is claimed provided a dwelling house is owned and occupied by the claimant on July 1 of that year.

. Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead credit. Edit Fill eSign PDF Documents Online. Dubuque Street Iowa City IA 52240 Voice.

Brad Comer Assessor Marty Burkle Chief Deputy Assessor. Dubuque County Courthouse 720 Central Avenue PO Box 5001 Dubuque IA 52004-5001 Phone. Iowa Code section 5612 defines the amount of property that qualifies for homestead treatment and these same definitions apply to the Disabled Veteran Tax Credit.

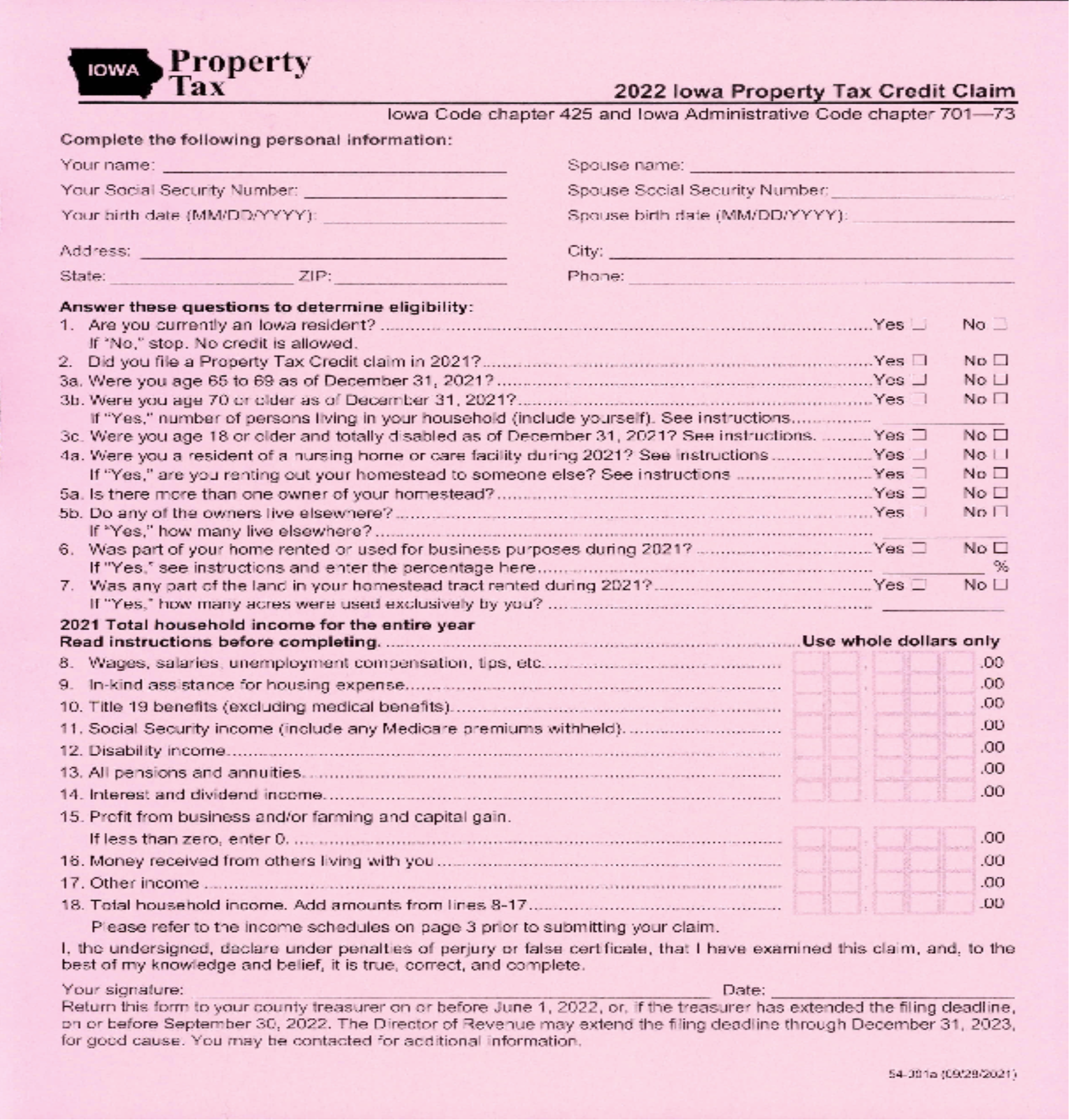

Homestead Tax Credit Application 54-028. Disabled Veteran Homestead Property Tax Credit Iowa Code section 42515 and Iowa Administrative Code rule 7018013 54-049a 10192020 This application must be filed with your city or county assessor by July 1 of the assessment year. Refer to Iowa Dept.

It is a onetime only sign up and is valid for as long as you own and occupy the home. Homestead Tax Credit Iowa Code chapter 425 This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed. Create an Account - Increase your productivity customize your experience and engage in information you care about.

54-049b 10192020 FACT SHEET. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. The amount of the credit is a maximum of the entire amount of tax payable on the homestead.

This application must be filed or postmarked to your city or county assessor on or before July 1 of the year in which the credit is first claimed. The Homestead Tax Credit is a small tax break for homeowners on their primary residence. Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as.

Upon the filing. Iowa City Assessor 913 S. Dubuque Street Iowa City IA 52240 Voice.

The Homestead Tax Credit is a small tax break for homeowners on their primary residence. NEW HOMEOWNERS--Be sure to apply for Homestead and Military Tax Credits. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801.

Ad Register and subscribe 30 day free trial to work on your state specific tax forms online. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed. To be eligible a homeowner must occupy the homestead any 6 months out of the year but must reside there on July 1.

Instructions for Homestead Application You must print sign and mail this application to. The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. Upon filing and allowance of the claim the claim is allowed on that.

This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed. It must be postmarked by July 1. 54-028a 090721 IOWA.

Disabled Veteran Homestead Tax Credit page 2. Iowa law provides for a number of exemptions and credits including Homestead Credit and Military Exemption. Military Service Tax Exemption Application 54-146.

In the case of a Disabled Veteran Tax Credit the value of the Homestead Credit is increased to the entire amount of the Taxable Value of the property. If the property you were occupying as a homestead is sold or if you cease to use the property as a homestead you are required to report this to the Assessor in. It must be postmarked by July 1.

Homestead Tax Credit Iowa Code chapter 425. Iowa City Assessor. Sioux City IA 51101.

Disabled Veterans Homestead Application - 54-049a. Of Veterans Affairs press release PDF Application Form. This credit must be filed with the assessor by July 1 annually.

7 enter the tax levy for your tax district x004332624. 913 S Dubuque St. What is a Homestead Tax Credit.

52240 The Homestead Credit is available to all homeowners who own and occupy the. For properties located within city limits the maximum size is 12 acre where the home and the buildings if any are located. Applications can be completed at our office or obtained online by clicking on Additional.

Upon filing and allowance of the claim the claim is allowed on that. In the case of a Disabled Veteran Tax Credit the value of the Homestead Credit is increased to the entire amount of the Taxable Value of the property. The property owner must live in the property for 6 months or longer each year and must be a resident of Iowa.

Fast Easy Secure. This exemption is a reduction of the taxable value of their property amounting to a maximum 4850 or the amount. Homestead Tax Credit Sign up deadline.

The Homestead Credit is a tax credit funded by the State of Iowa for qualifying homeowners and is generally based on the first 4850 of Net Taxable Value. July 1 This credit is calculated by taking the levy rate times 4850 in taxable value. If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site.

This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed. Youll need to scroll down to find the link for the Homestead Tax Credit Application. Iowa Code chapter 425 and Iowa Administrative Code rule 701 801.

This application must be filed or postmarkedto your city or county assessor on or beforeJuly 1 of the year in which the credit is first claimed. The tax year runs from July 1 to June 30 in Johnson County. Brad Comer Assessor.

It is the property owners responsibility to apply for these as provided by law. Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead credit. Upon filing and allowance of the claim the claim is allowed on.

2015 HF 166 Veterans Credit modifying eligibility PDF Iowa Family Farm Land Credit. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. Iowa City Assessor 913 S.

The credit will continue without further signing as long as it continues to qualify or until is is sold.

What Is A Homestead Exemption And How Does It Work Lendingtree

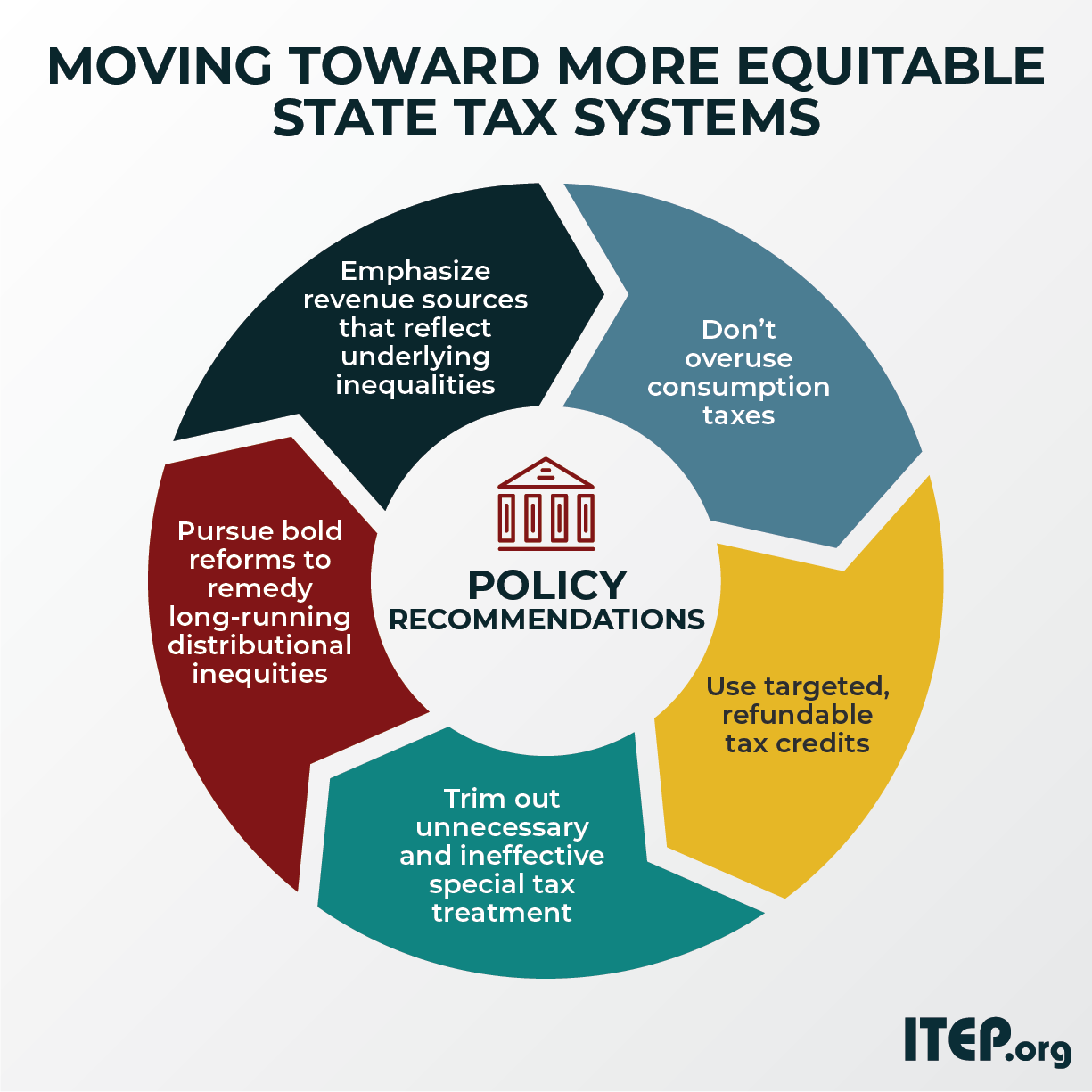

Moving Toward More Equitable State Tax Systems Itep

Property Tax Relief Polk County Iowa

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

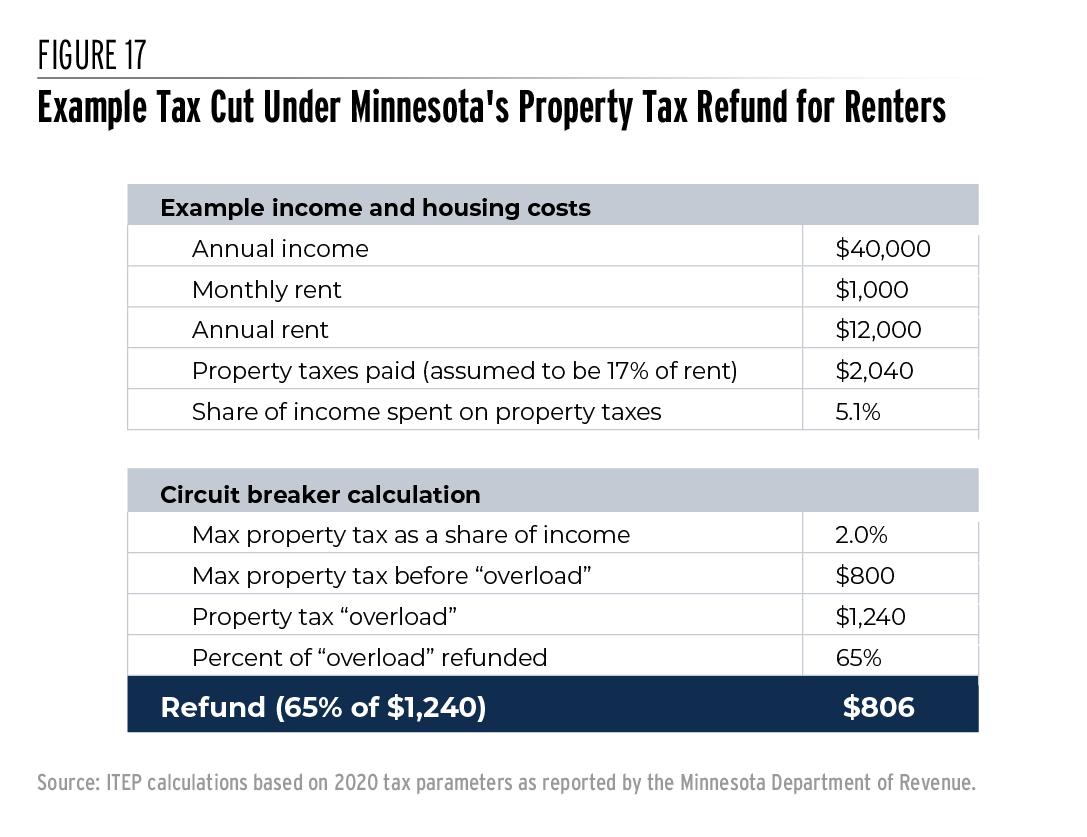

Property Tax Homestead Exemptions Itep

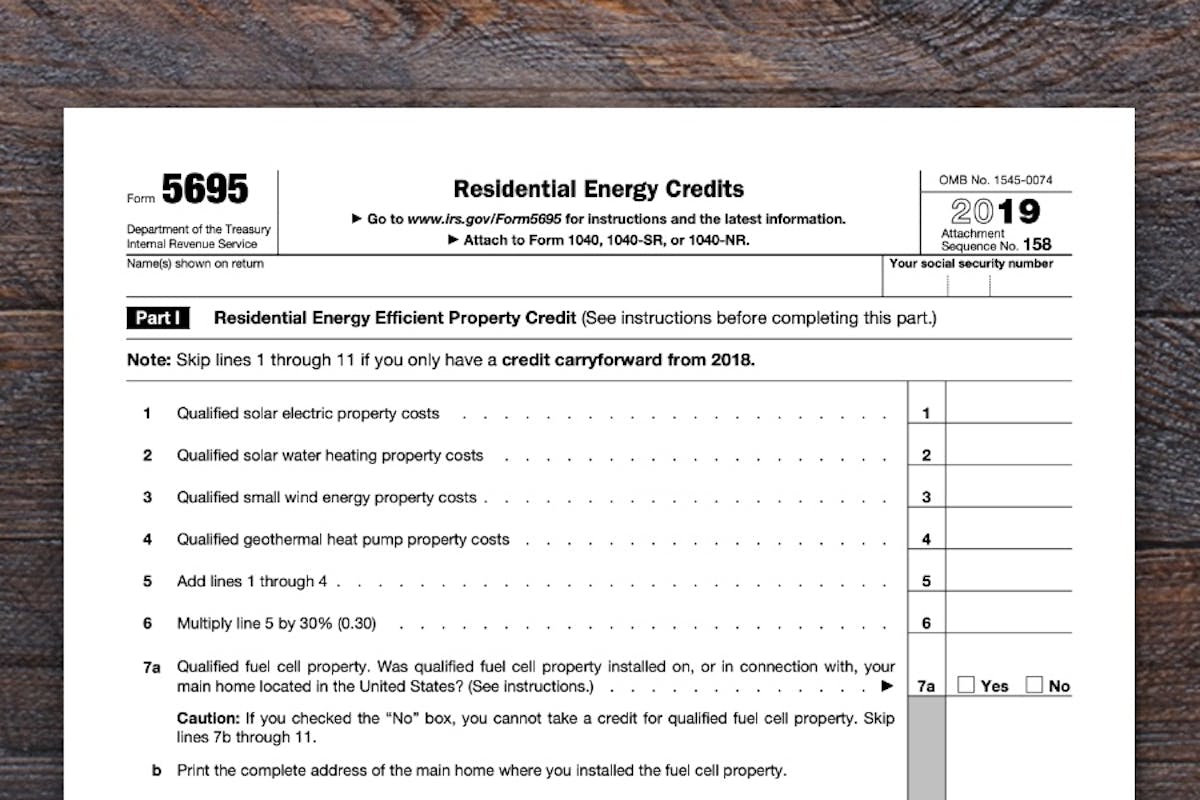

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

Available Tax Credits Deductions To Generate Cash Flow

State Historic Tax Credits Preservation Leadership Forum A Program Of The National Trust For Historic Preservation

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

American Opportunity Tax Credit H R Block

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Property Taxes Marion County Iowa

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Everything You Need To Know About The Solar Tax Credit Palmetto

Our Free Cost Of Living Calculator Allows You To Compare The Cost Of Living In Your Current City To Another Retirement Calculator Financial Advisors Retirement